Author - Andria Cheng, Forbes Contributor

The Surprising Trend In Beauty? Skincare Sales Growing The Fastest Among Men's Grooming Products

If you intend to, but haven’t bought anything for Father’s Day yet, consider adding an anti-aging cream or even facial sheet masks to your gift list of razors, game tickets or smart home devices.

It turns out more than one-third of American dads -- and the percentage goes up to about two-fifths among those with two children -- say they care about preventing the signs of aging, compared to 23% of men without kids, according to a Mintel study released this week that surveyed about 1,000 male personal-care product adult users in the U.S.

In another telling sign, while some 95% of men in the survey say they use deodorants and 87% say they use body cleansing products, 70% of men say they use sunscreen/sun protection items while nearly two-thirds say they use facial skincare. Among those between 18 and 44, facial skincare users actually jump to as much as 84%, the study shows.

Try searching for “men anti-aging cream” on Amazon and more than 1,000 results will appear under beauty and personal care category, spanning products from mass-market and drugstore labels (L'Óreal "Men Expert" and Neutrogena Men) to department store brands (Estée Lauder-owned Clinique for Men sells an anti-age moisturizer for $44).

In fact, while the stubble/beard trend has hurt industrywide U.S. shaving product sales, the largest men's grooming category, demand for men’s skincare items has seen healthy growth. Sales of men’s shaving products were $2.8 billion last year, declining an average of 1.1% a year between 2012 and 2017. In contrast, the annual average growth for men’s skincare products during the same time period was 7.2%, with sales reaching $345 million in 2017, according to Euromonitor data.

Last year alone, men’s skincare product sales jumped an even faster 11%, outpacing growth in all other men’s grooming categories including bath and shower, deodorant and hair care. In total, men spent a total of $6.9 billion in the U.S. on grooming products last year, Euromonitor data shows.

Men ages 35-44, and especially dads, will drive the overall grooming market demand as they are “more invested in the category and less price sensitive than other groups,” Mintel said. Nearly three-fifths in that age group say they “pay attention to” the personal care products they buy, compared to less than half for the entire male adult group surveyed, according to Mintel.

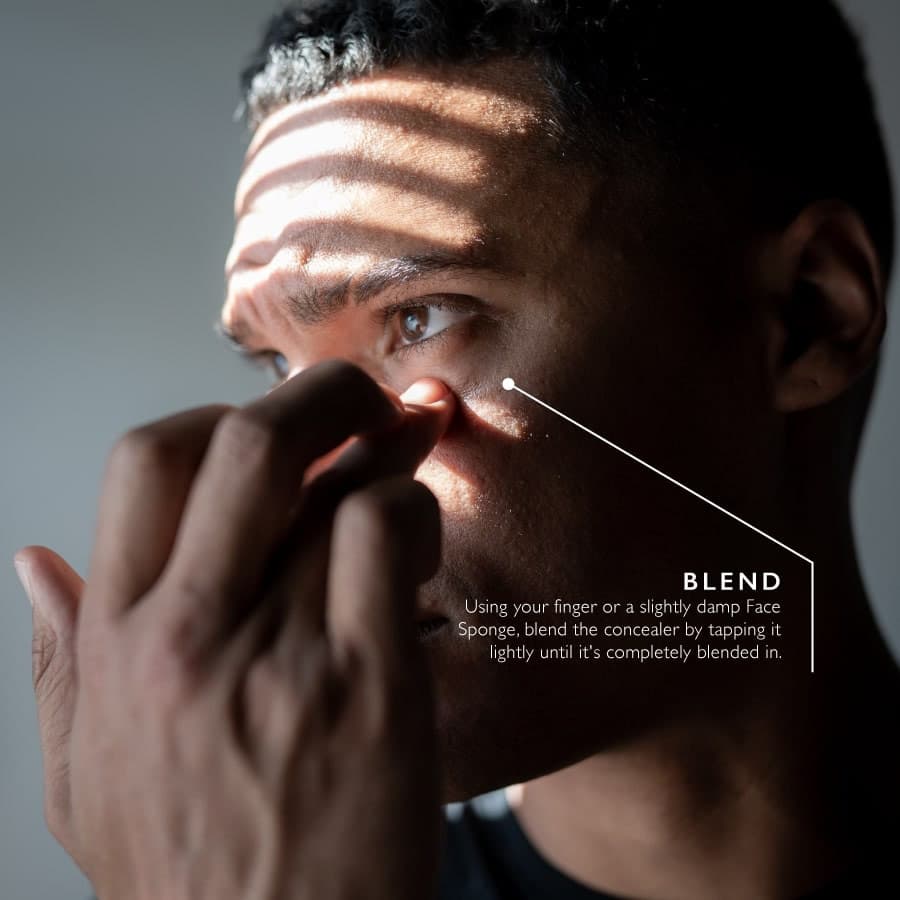

Major brands, such as Unilever’s Dove, L'Óreal, and Johnson & Johnson's Neutrogena, have responded to the market potential for men's skincare.

Retailers aren't blind to the demand either. For instance, on beauty retailer Ulta’s website, there’s a separate tab for men’s products, including "anti-wrinkle" serum and other skincare. In April, Target picked men’s skincare brand Oars & Alps among 10 beauty startup labels it would mentor and grow under its startup accelerator program. Target said it’s seen a lot of customer interest in smaller niche brands including those for men.

However, the hustle and bustle of activity may not be coming fast enough: Only 4% of men’s personal care products unveiled in the U.S. last year included anti-aging claims, according to Mintel study.

“The discrepancy between the number of men interested in preventing the signs of aging and the number of products touting these benefits indicates a significant opportunity,” the report said.

Expect to see an expanded beauty and personal care aisle for men at your local drugstores and beauty retailers.

Copyright: Forbes. Author - Andria Cheng, Forbes Contributor